"Solar Energy is a clean and free natural resource, available to the mankind. The effective use of this un-tapped energy resource has huge potential to develop every corner of the globe, and establish a peaceful, safe and pleasant world for our future generations. It is our responsibility to start this onerous but honorable task"

Tuesday, December 28, 2010

Monday, December 27, 2010

Thursday, December 23, 2010

First Solar to reach nearly US$4 billion in sales in 2011: French plant cancellation threatened | PV-Tech International

First Solar announced that NRG Energy has agreed to acquire the 290MW (AC) Agua Caliente solar project from First Solar, currently the largest planned PV power plant in the world. The project is scheduled to be completed by 2014 and has a 25-year power purchase agreement with Pacific Gas and Electric Co. NRG plans to invest up to US$800 million of equity in the project through 2014.

MONER.pdf Jawaharlal Nehru National Solar Mission Building Solar India

Jawaharlal Nehru National Solar Mission Building Solar India

Application segment Target for Phase I (2010-13)

Grid solar power 1,000 MW roof top 100 MW

Off-grid solar applications (incl. rural solar lights) 200 MW 2 million

Monday, December 20, 2010

Understanding Thin Film Prices: A Dummy’S Guide | Article | Solarplaza | The global solar energy (PV) platform

You know and I know it: thin-film PV modules have to be cheaper than crystalline silicon, and it's the efficiency, stupid. With regard to efficiency, thin-film module prices require a downwards adjustment relative to c-Si to overcome the efficiency-induced BOS cost differential; the exact penalty depends on the BOS price (in dollars or euros per square meter), as well as the efficiencies of the technology in question.

By Shyam Mehta

The figure below displays the effect of efficiency and BOS price on module prices for CIGS and CdTe as a percentage of a 14% c-Si module price. As shown, an 11% CdTe module would have to sell at around a 14% discount to drive the same installed system cost, while in the case of an 11% CIGS module, the discount is around 8%. As a real-life example, integrators and installers indicated in June 2009 that First Solar would have to sell for a discount of around EUR 0.20-0.25/Wp (around $0.28-0.35/Wp) to be competitive with c-Si modules at the time, which amounts to a discount of EUR 0.06-0.08/Wp ($0.09-0.11/Wp) per point of efficiency difference.

Less well-known, and offsetting the impact of BOS and efficiency, however, is the variable of performance. Due to superior temperature coefficient and spectral sensitivity, thin-film technologies generally have better kWh-per-kW energy yield than c-Si technologies, which gives them an advantage in driving a lower delivered cost of electricity. Until recently, this factor was not really incorporated in module pricing, as reliable data on performance were not available for thin film systems; moreover, changing the focus from $/Wp to $/kWh requires a level of sophistication that many distributors and developers heretofore have lacked.

Source: National Renewable Energy Laboratory (NREL), GTM Research

In early 2010, however, juwi Solar, a large German developer, looked at operating data from its many CdTe installations and attempted to incorporate these into an analysis of rational pricing. These results are presented in the figure below. As can be seen, when kWh/kW performance is taken into account along with efficiency/BOS impacts, thin-film module prices require much less downward adjustment relative to c-Si. An 11% CdTe module here needs only a 6% discount to be competitive with 14% c-Si (as opposed to 14% discount when only efficiency/BOS is considered).

Source: juwi Solar

The graph below presents the same data, this time with module prices shown in $/Wp, and adding amorphous silicon, whose pricing curve is slightly below that of CdTe. As shown, assuming a Chinese multi c-Si module price of $1.75/Wp (representative of Q2 2010 pricing), CdTe would sell for $1.65/Wp -- a discount of only $0.10/Wp, compared to the $0.28-0.35/Wp that would be required if only efficiency is being taken into account. Similarly, a CIGS at 12% would be priced at $1.61/Wp. In the case of amorphous Si, a 9% tandem-junction module would be at $1.39/Wp, while a 7% single-junction module would only fetch $1.15/Wp -- undoubtedly below or close to cost for most manufacturers, which suggests that single-junction a-Si is not a competitive option against Asian c-Si.

Source: juwi Solar, GTM Research

Aside from a rare few, however, most thin film manufacturers still have to offer meaningful discounts over and above that required by the technological differences described above. This is necessary to offset concerns of bankability and product reliability, as many thin film companies are smaller and less established, and field data is not yet available for their modules. In fact, as the graph below makes clear, even First Solar was not immune to this effect in the not-too-distant past. The graph shows four series:

1. Actual historical prices for Chinese multi c-Si (yellow)

2. Actual historical prices for First Solar (blue)

3. First Solar ASP based on BOS/efficiency, but not performance (red)

4. First Solar ASP based BOS/efficiency, and performance advantage (green)

First Solar was selling its modules at a hefty discount all throughout 2007 and 2008, far below the expected ASP just based on BOS/efficiency differences, ignoring performance (the red line). This was done to drive market traction and get the company's modules in the field, and the high utilization drove further cost reductions through scale. By early 2009, First Solar was an established and bankable producer, and when the market turned and c-Si prices dropped by 25%, First Solar saw ASP declines of only 5%, sharply reducing the discount offered. Although protection through long-term contracts was also responsible for softening the company’s ASP drops, prices would certainly have been re-negotiated if they were not competitive. Indeed, this was done indirectly in Q2 and Q3 2009, as aggressive pricing by Chinese firms forced First Solar to establish a rebate program which retroactively set its module ASP in sync with c-Si prices. At the same time, the spread between actual and “expected” prices continued to drop, and by Q3 2009, ASPs were in line with the efficiency-based required price.

Since then, First Solar ASPs have remained stable even as c-Si prices continued declining, to the point where in Q1 and Q2 2010, ASPs converged to the expected performance-based selling price -- a discount of only 4% to 7%, compared to nearly 40% back in 2008. This signifies both the pricing power enjoyed by First Solar in a market needing bankable product, as well as the fact that its customers have woken up to the additional value offered by CdTe’s superior energy yield, and are willing to pay accordingly. Going forward, as the thin-film PV market continues maturing, one would expect this to be the case for other firms and technologies, as well.

This is an excerpt from GTM Research's recently published global PV supply chain report, PV Technology, Production and Cost Outlook: 2010 - 2015. The report addresses technical characteristics, production/capacity volumes, facility-specific manufacturing costs, supply-demand dynamics, and competitive positioning across all relevant PV technologies and nearly 200 wafer, cell, and module firms. For more on the report, go here .

SunPower Closes 195M Solar Bond; Completes 77 MW Montalto di Castro Solar Park (Dec 16, 2010)

SunPower announced the completion of the entire 72-MW Montalto di Castro solar park, which is one of the world's largest solar parks in terms of energy generation

Friday, December 17, 2010

SolarWindow™

New Energy Technologies is developing the first-of-its kind SolarWindow™ technology, which enables see-thru windows to generate electricity by ‘spraying’ their glass surfaces with New Energy’s electricity-generating coatings.

- Almost 2-fold greater output power density than monocrystalline silicon, an established commercial solar cell material;

- More than 8-fold greater output power density than copper-indium-selenide, known for its high optical absorption coefficients and versatile optical and electrical characteristics; and

- More than 10-fold greater output power density than flexible thin-film amorphous-silicon, a popular ‘second-generation’ solar thin-film material.

- World’s smallest known organic solar cells

- Generates electricity from artificial light as well as natural light sources

- Does not require expensive high-temperature or high-vacuum production

Solar Feed in Tariff in France Halted as Renewable Energy Subsidies become “veritable speculative bubble” « Green World Investor

France will have 860 megawatts of photovoltaic capacity installed and connected to the grid at the end of 2010 and a total of 2,150 megawatts by the end of next year,

Feed in Tariff in Taiwan – Wind Energy to be strangely Increased while for Solar Sensibly Decreased « Green World Investor

Feed-in tariffs, or the prices that state-run utility Taiwan Power Co. pays generators, are at least NT$11.12 (37 cents) per kilowatt-hour for photovoltaic solar panels and NT$2.38 for wind farms, the energy bureau said in a statement on its website in December last year. That compares with an average cost of NT$2.06 per kilowatt-hour for fossil fuels such as coal and oil.

Tuesday, December 7, 2010

GLOBAL OVERVIEW ON GRID-PARITY EVENT DYNAMICS

GLOBAL OVERVIEW ON GRID-PARITY EVENT DYNAMICS

Saturday, November 27, 2010

Tuesday, November 23, 2010

PRTM_Photovoltaic_Report_2010.pdf (application/pdf Object)

PHOTOVOLTAIC SUSTAINABLE GROWTH INDEX

A New Competitive Environment for PV Companies

Thursday, November 18, 2010

Wednesday, November 17, 2010

SW-Carousel-trackers.pdf (application/pdf Object)

SOLAR PV CAROUSEL TRACKERS FOR BUILDING FLAT ROOFTOPS:

THREE CASE STUDIES

Saturday, November 13, 2010

Wednesday, November 10, 2010

Thailand: Suntech to supply solar panels to 44 MW solar project : pv-magazine

Suntech Power Holdings Co., Ltd. has announced it will supply 9.43 megawatts (MW) of solar panels and technical support for the second phase of a 44 MW solar power plant (38MW AC output) in Thailand

Monday, November 8, 2010

Friday, October 29, 2010

Tuesday, October 19, 2010

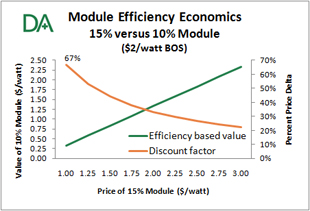

Economics of Efficiency in PV Systems | d-bits

As prices drop, lower efficiency modules require greater price discounting

As prices drop, lower efficiency PV modules require higher discounting

Monday, October 18, 2010

Are Solar Thermal Power Plants Doomed? : Greentech Media

Again, PV is cheaper today, and expected to widen its edge over the next decade. By 2020, the CSP technologies are expected to be in the $0.10-$0.12/kWh range, whereas PV is forecast between $0.07-$0.08/kWh.

he relentless price declines of PV panels allows developers to build PV plants at a lower cost than their CST cousins. This issue is illustrated in the following Capital Cost per watt chart (an excerpt from the upcoming GTM Research "CSP Report"). In 2010, the price to build a CSP park run by Troughs, Power Towers or Dish-Engines will cost between $5.00 and $6.55 per watt (AC). On the other hand, utility-scale PV projects can limbo below $3.50 a watt (DC).

By 2020, the CSP solutions are expected to be in the $2.40-$3.80 per watt (AC) range, but by that time PV plants could be below $2 a watt (DC). Trough & Tower plants are behind PV, and not likely to catch up.

http://www.greentechmedia.com/content/images/articles/Capital%20Cost(1).pnghttp://www.greentechmedia.com/content/images/articles/LCOE(1).png

It's like that old, painful axiom in semiconductors.

Don’t bet against silicon.

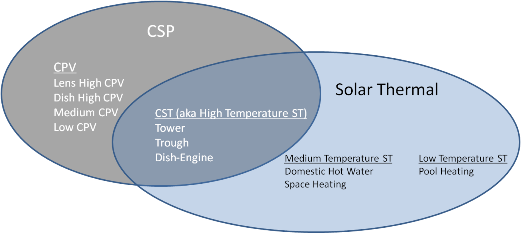

PS - for a clarification on our categorization scheme, see diagram below

Wednesday, October 13, 2010

Thursday, October 7, 2010

Sri Lanka first coal power project- Norochchole Plant to go online in November | Asian Tribune

Please check on fuel cost of unit fuel cost alone is Rs 4.72/kWh

Tuesday, October 5, 2010

UNEP_GTR_2010.pdf Global Trends in Sustainable Energy Investment 2010

Analysis of Trends and Issues in the Financing of Renewable Energy and Energy Efficiency

Monday, October 4, 2010

80MW Sarnia Project Complete in Ontario Canada

80 MW Sarnia Project Complete in Ontario now the world largest PV project

http://www.solarnovus.com/index.php?option=com_content&view=article&id=1446:80mw-sarnia-project-complete&catid=41:applications-tech-news&Itemid=245

First Solar, Inc. and Enbridge Inc. have completed the expansion of the Sarnia Solar Project in Ontario, Canada from 20 megawatts (MW) of capacity to 80MW making it the largest operating photovoltaic (PV) facility in the world to-date.

The Sarnia Solar Project - 80 MW now online, represents approximately $400 million of investment and enough electricity each year to power more than 12,000 homes - or about 40 per cent of homes in the City of Sarnia. Construction of the project created about 800 jobs.

Friday, October 1, 2010

Thursday, September 30, 2010

Wednesday, September 29, 2010

PAYBACK ON RESIDENTIAL PV SYSTEMS WITH 2009-2016 UNCAPPED 30% FEDERAL INVESTMENT TAX CREDIT

PAYBACK ON RESIDENTIAL PV SYSTEMS WITH 2009-2016 UNCAPPED 30% FEDERAL INVESTMENT TAX CREDIT

http://www.ongrid.net/papers/ResPVEconomicsWithUncappedITC_ASES09web.pdf

The United States federal government enacted an extension and expansion of the 30% Federal Investment Tax Credit (ITC) for individual (residential) tax filers in October 2008. The expansion from a former cap of $2,000 on the ITC to the new uncapped full 30% ITC substantially reduces the net cost of ownership, and thereby dramatically improves the potential financial returns and benefits to many prospective customers. This paper presents revised and expanded financial analyses of residential cases presented in previous papers. It will

look at Internal Rate of Return (IRR) only (for simplicity of cross comparison) for the previously studied Northern California cases, accounting for the increase in the ITC and brought up-to-date with current electric tariffs, incentives (federal, state & local) and, as applicable, Solar Renewable Energy Certificate (SREC) values. The paper then expands coverage to additional US states (NJ, NC, CT, AZ, HI, CO), and also performs a couple of “what if” scenarios to illustrate the effects of changes in individual variables.

PaybackOnSolarSERG.pdf (application/pdf Object)

Press Hear for the paper on "Economics of Solar Electric systems for consumer and other Financial tests"

GridParityRedHerring.pdf

Grid Parity has been discussed as a single cost per kWh, with the implication that when the PV industry delivers energy at that price, the market opportunity will explode. This paper will show that there is no single cost per kWh or price per installed kW of PV that hits or beats “grid parity”, but rather, “grid parity” is a range of prices per kWh over which potential customers with varying individual circumstances and a range of prices and performances of the systems being offered to them, will find PV systems more or less attractive.

PV Sys Int Wkshp (Mar2010) Levelized Cost Of ElectricitySensitivity AssessmentSandia

Levelized Cost Of Electricity Sensitivity Assessment Sandia

Friday, September 24, 2010

Get FiT Programe

Very good feed in Tariff analysis

Thursday, September 23, 2010

Reports - (SEPA) PV Technology Characterization Review - September 2010

PV

The PV market continues its explosive growth and simultaneously a wide array of commercially available PV

CdTe costs $0.90/Wp. CIGS costs $1.20 to 1.80/Wp. x-Si @ $1.6 to 2.3/Wp. Super efficient c-Si $2.5/Wp

By 2015 the prices will drop to Thinfilms bellow $1/Wp and x-Si be $1.10/Wp.

Inverters have longer life will serve 20 years life and the prices are dropping. Micro inverters will be mostly used.

Click hear for full report or

http://www.solarelectricpower.org/media/154545/pv%20technologies%20executive%20summary.pdf

From http://www.solarelectricpower.org/resources/reports.aspx