Bunker Prices, Friday April 8, 2011

| Grade | IFO380 | IFO180 | MDO | MGO |

|---|---|---|---|---|

| Fujairah | 686.50 | 711.50 | 1035.50 | |

| Houston | 677.50 | 718.00 | 1025.00 | |

| Rotterdam | 659.50 | 681.00 | 1049.00 | |

| Singapore | 684.50 | 697.50 | 1041.00 | 1045.00 |

The Japanese plant 50MW at the port uses IFO380 imported.

If CEB does not buy the IFO380 from CPC it will be forced to transport after heating by costly shipping to Singapore and sell at a loss. CEB is doing a service to CPC and the country! GoSL should give at cost or even subsidize this fuel!.

The Diesel imported into the country has a large component of import Tax and levies when that is sold in the Market (This is almost>30%). This is GoSL policy and this extra revenue is used to maintain the Roads and highways in the country where the vehicles use same.

It is unfair to charge these diesel prices for diesel supplied to CEB for Power Generation.

Like Coal CEB should be allowed to import liquid fuels import duty and levy and other harbor charges free. Then CEB can run profitable and reduce the Tariffs

WTI: $112.79 Change: 2.49

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| Price | Change | Trades | Volume | ||||

| 22:37 - $ 113.05 |  0.26 0.23% 0.26 0.23%  | 153,378 | 287,494 | ||||

| Range | Open | 52 Wk Range | 1 Year Forecast | ||||

| 110.11 - 113.21 | 112.44 | 68.01 - 113.21 | $130 / Barrel | ||||

| 1 Year Forecast | ||

| $130 / Barrel |

From http://www.oil-price.net/

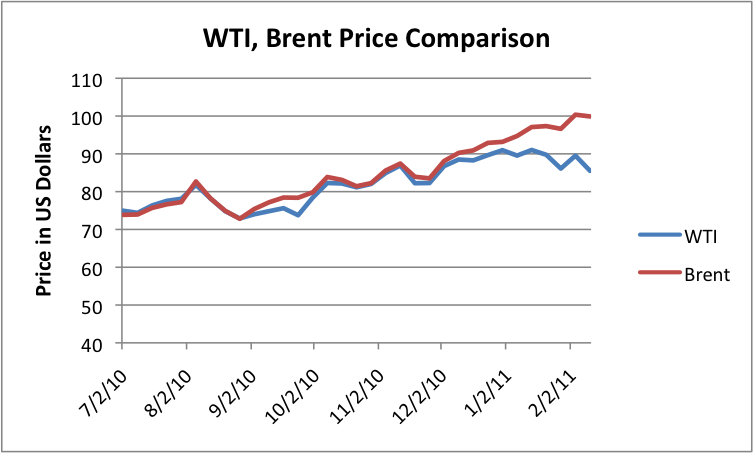

We have been told that the Midwest is oversupplied because of all of the Canadian imports, and the crude oil cannot get down as far as the Gulf Coast, because while there is pipeline capacity to the Midwest, there isn’t adequate pipeline capacity to the Gulf Coast. I have done a little research and tried to add some more context and details. For example, the opening of two pipelines from Canada (one on April 1, 2010 and one on February 8, 2011) seems to be contributing to the problem, as is rising North Dakota oil production.

There are two pipelines (Seaway – 430,000 barrels a day capacity and Capline – 1.2 million barrels a day capacity) bringing oil up from the Gulf to the Midwest. It is really the conflict between the oil coming up from the Gulf and the oil from the North that is leading to excessive crude oil supply for Midwest refineries and the resulting lower price for WTI crude oil at Cushing. Demand for output from the refineries remains high though, so prices for refined products remains high, even as prices for crude oil are low. This mismatch provides an opportunity for refiners to make high profits.

http://www.hiwtc.com/photo/products/10/00/23/2346.jpg

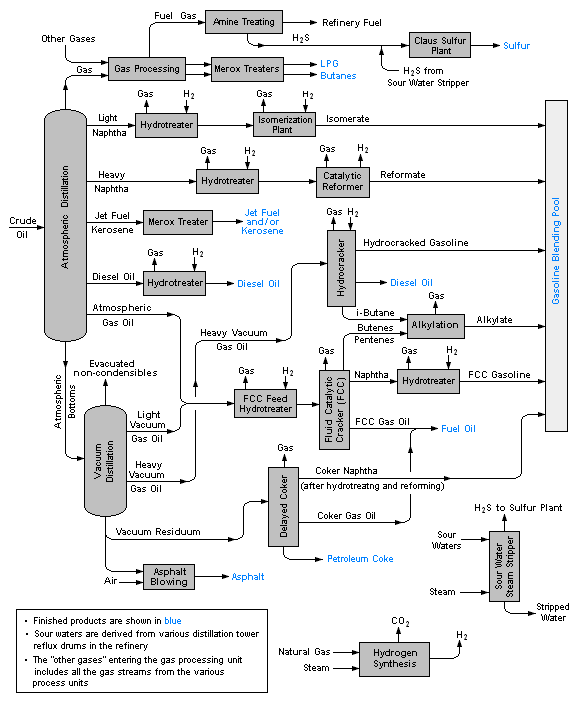

http://upload.wikimedia.org/wikipedia/commons/6/60/RefineryFlow.png

crude oil: product contents

No comments:

Post a Comment